hawaii general excise tax id number

3 rows Old Hawaii Tax ID Number Format New Hawaii Tax ID Number Format. Tax Reporting of Scholarships and Fellowships.

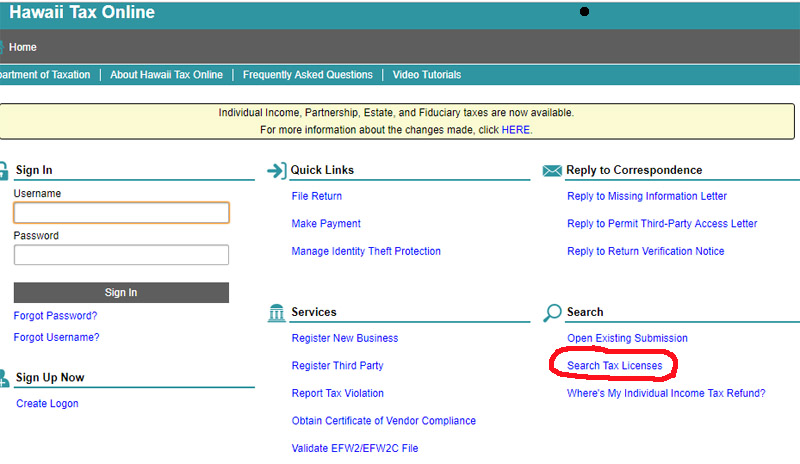

Hawaii Business License License Search

Get Your Hawaii Tax ID State Tax Licenses 12 Do I need to register with DOTAX.

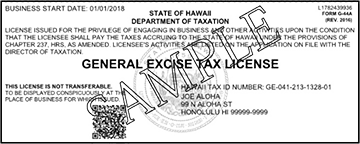

. While hawaii tax id numbers have changed for corporate income franchise and public service company tax accounts existing federal employer id. The Hawaii SalesTax ID card that is issued after the modernization project with a 13 letter heading is titled GE. Employment tax employer taxes and excise taxes.

Hawaii tax id number 12 digits. Travel and Moving Expenses. Check on whether a business or individual has a general excise tax license with the State of Hawaii Department of Taxation.

Tax accounts that have been upgraded will be distinguished by a new Hawaii Tax ID starting with a two-letter account type identifier and 12 digits. This is a general business tax number also called a tax id or home occupation permit that all businesess must obtain. You should not enroll in AutoFile using a Hawaii Tax ID that begin with abbreviations for other tax types such as CO.

An extension for an additional two 2. Hawaii Tax ID Number A tax account with a two alpha character tax type prefix followed by a ten digit Hawaii tax. Tax Office at UH can prepare such form and sign it and provide the address of your office and an email address where such signed.

It offers a number of online resources for consumers including licensee status and licensing complaints tax and business registration and other educational materials. The GET is similar to a sales tax but is actually a privilege tax based on the gross income of most business activities in the State of Hawaii. Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits.

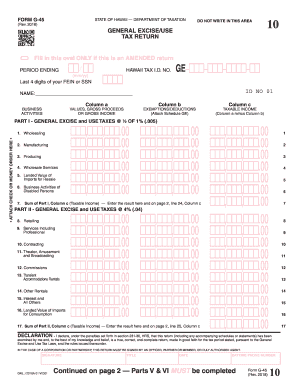

34 rows General Excise and Use Tax Forms. A sole proprietor must also obtain a general excise tax GET license filetax returns and pay GET on his or her gross. The Legislature also authorized county governments.

To learn more about the differences between the GET and sales tax please see Tax Facts 37-1 General Excise Tax GET. The state of Hawaii began a new process in 2017 that now requires a 12 digit business ID number. This number is distinct from your federal tax ID number and its important to realize.

For example if you are paying for the tax due for general excise taxes for the month of january 2019 the date would be reported as 190131. If you received a. Check out the rest of this guide to find out who needs a General Excise.

See Hawaii Tax ID Number Changes for more information. Find resources for Government Residents Business and Visitors on Hawaiigov. Tax year ending hawaii tax id.

To learn more about the differences between the GET and sales tax please see Tax Facts 37-1 General Excise Tax GET. 11 rows If you are stopping your business temporarily you can request to put your general excise tax transient accommodations tax rental motor vehicle tour vehicle and car-sharing vehicle surcharge tax and withholding tax licenses on hold using Form L-9An account may be put on Inactive status for up to two 2 years. Hawaii General Excise Tax.

General Excise Tax License Search. A Form W-9 may be requested by the payor for UHs federal identification number. The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others.

It is the only state outside North America the only state that is an archipelago and the only state in the tropicsHawaii is also one of four US. The General Excise Tax license is obtained through the Hawaii Department of Taxation as a part of applying for a Hawaii Tax Identification Number. Unrelated Business Income Tax.

This ID number should not be associated with other types of tax accounts with the state of Hawaii such as income tax. GE-999-999-9999-01 All sales tax related account IDs begin with the letter GE to reflect the tax type. Our old system assigned a Hawaii Tax ID starting with the letter W followed by 10 digits.

All businesses must obtain a Hawaii Tax Identification Number HITax ID and.

A Fairly Thorough Explanation Of Hawaii General Excise Tax Get For Beginners 2019 Youtube

Rates And Availability At Kihei Akahi Dg13 Maui Vacation Rental Condo

Hawaii State Tax Golddealer Com

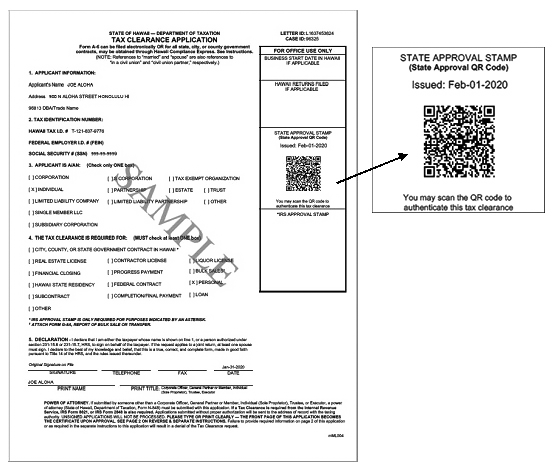

Tax Clearance Certificates Department Of Taxation

County Surcharge On General Excise And Use Tax Department Of Taxation

Sales Tax Tuesday 2018 Hawaii Special Edition Insightfulaccountant Com

Michael V David Dba Klu Consulting

Hawaii General Excise Tax Everything You Need To Know

Hawaii General Excise Tax Everything You Need To Know

Licensing Information Department Of Taxation

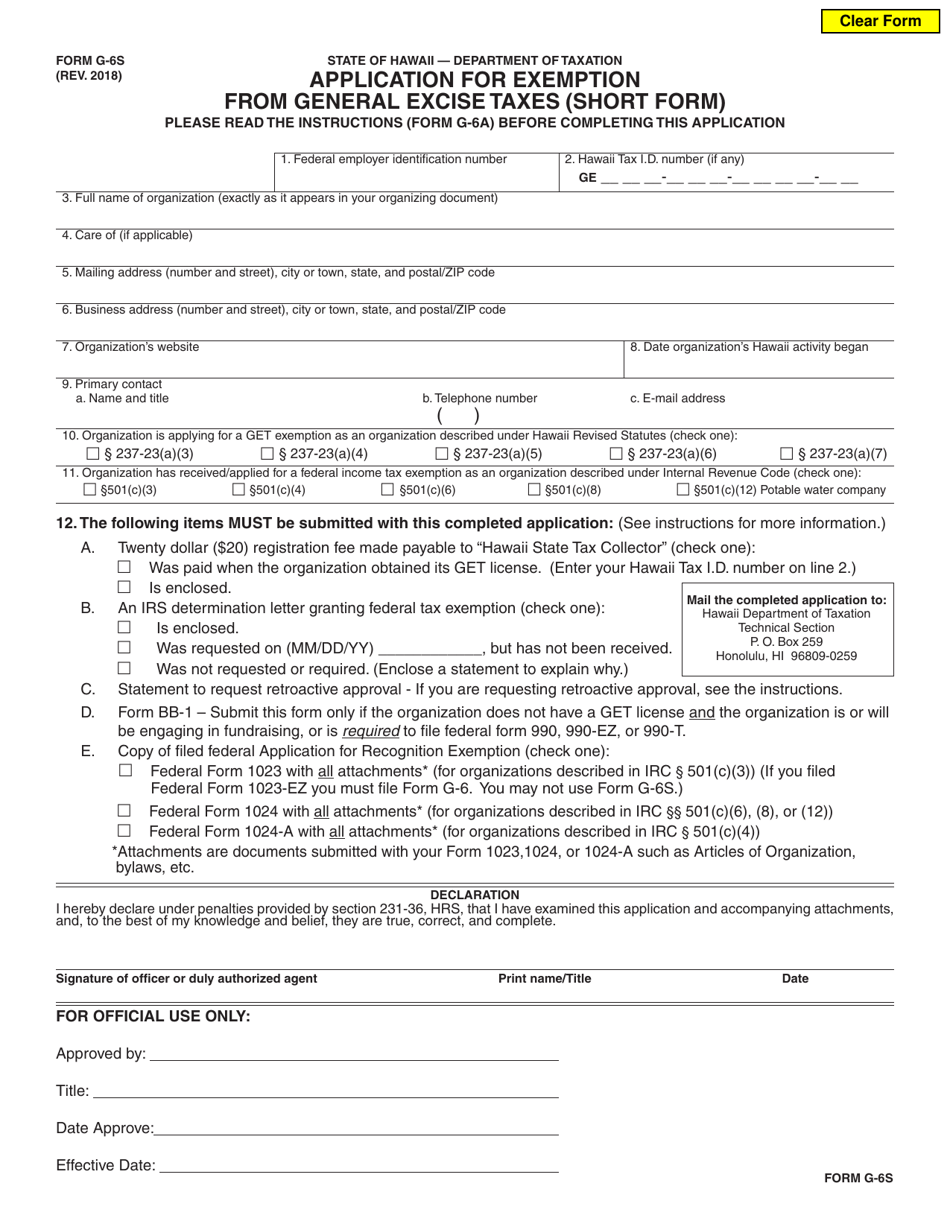

Form G 6s Download Fillable Pdf Or Fill Online Application For Exemption From General Excise Taxes Short Form Hawaii Templateroller

Hawaii Tax Online G45 Fill Out And Sign Printable Pdf Template Signnow